CMH Knows its Place (At The Top)

23 April 2019

Group's financial position as at 28 February 2019.

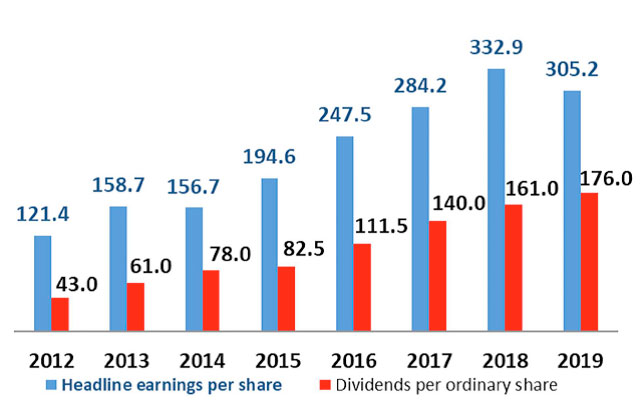

Revenue for the year increased to R11.155 billion (2018: R10.573 billion), gross profit rose to R1.825 billion (2018: R1.766 billion), dividends paid per share is up by 9%, the net asset value is up by 13% with a return of 31% on shareholders funds and cash resources up by 81%.

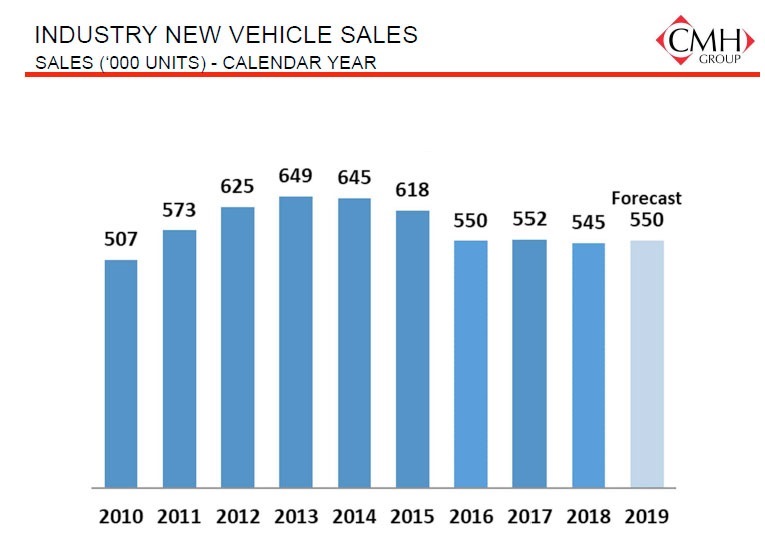

It is also worth a mention that the CMH Group did better than most with a challenging year like 2018 considering the fact that National vehicle sales decreased by 1.3% whilst CMH vehicle sales increased by 1.9%

Dividend

A dividend (dividend number 62) of 115 cents per share will be paid on Tuesday, 18 June 2019 to members reflected in the share register of the Company at the close of business on the record date, Friday, 14 June 2019.

Figure 1: Headline earnings and dividends per share

Company Prospects

Predictions of national motor sales growth for calendar 2019 vary but there are talks of up to +2%, and another positive factor is that interest rates appear to be stable, and, in real terms, new vehicle affordability continues to improve.

Figure 2: Industry New Vehicle Sales

NAAMSA has recently reported that the rate of new vehicle price increases has been well below the CPI for the last 15 months. Competitive pressures facing motor manufacturers are likely to ensure that attractive sales incentives continue.

The Group is in a sound financial position. Its financial statements record a solid and stable asset base, backed by strong cash flow generation. Costs have been reduced to a minimum, and the management team is experienced, hardworking and enthusiastic.

PDF 1: Download this PDF to see full CMH Presentation

Book a car with the CMH Group, book First Car Rental.